1. Individuals

Individuals who own rental property need to calculate the income or loss from the property for each calendar year. This is then adjusted with the other personal income for the year.

If the property is co-owned, then each co-owner must individually report their rental income according to the portion owned. Keep in mind that rental losses or gains may be subject to the Alternative Minimum Tax (AMT).

Individuals have an advantage over corporations when they own rental property. They are not taxed on the capital at the federal level nor in the provinces where a capital tax exists.

2. Partnerships

In this case the income is calculated as if the partnership is a separate person. The partnerships income or loss is then attributed to the partners. The Capital Cost Allowance (CCA) and other deductions are also claimed when calculating the income.

If the partners are individuals then they need to include their share of the financial expenses paid by the partnership in calculating their adjusted income for the purposes of the ATM and expenses related to any borrowing that occurred in order to invest into the partnership.

In terms of the AMT, there are no benefits to the rental property being held by a partnership instead of being co-owned.

If the partners are corporations, then they have the option of deferring payment of income tax if the corporation has an earlier year end than the partnership. The calculation of federal and provincial tax will be done differently. You also need to include the corporation’s share of the property as shown on the partnerships balance sheet in order to calculate their taxable capital.

3. Corporations

Corporations pay tax on their taxable income which includes rental income. If the primary business activity of the corporation is the sale or rent of real property then the restriction on the amount of CCA that it can claim will not apply. For this reason, it can be preferable to create a separate corporation for real estate businesses rather than combining the real estate business with other ventures.

In some circumstances, ownership of the property by a corporation might not be beneficial especially if rental losses are expected and the corporation has no other sources of income. This is because shareholders cannot take advantage of these losses by deducting them from their personal income.

Active and Passive Income

Active income can be understood as income which is derived from business activities that are hands-on such as professional services, retail or sales.

Passive income would be income derived from property such as dividends, interest and some rents. The management of a rental operation can take up a large amount of time and effort from the owner and feels anything but “passive”. But the Tax Act clearly states that rents from real property are “passive” sources of income.

Specified Investment Business

This is a business whose principal purpose is to generate income from property such as rents, dividends, interest and royalties. This business exists when five or fewer full-time employees are engaged in the property rental activity. So if owning a rental property is a secondary investment activity, then there is no advantage in a corporation owing it since the applicable tax rate will be greater than the rate an individual would pay.

Converting Passive Rental Income into Active Business Income

This can be done in the following 3 ways.

- If the property is rented to an associated corporation that deducts the rent from its active business income, then the rental income will be considered as an active business income regardless of the five employee rule. As an active business, it will be eligible for the small business deduction.

- Also, if more than five full-time employees are needed to run the rental operation then the corporation will become an active business and will be entitled to claim the small business deduction.

- Another way is the “Temporary Income Surge”. For example during a particular period a corporation that usually mostly earns active income, earns rents or other passive income in a large amount temporarily, maybe because of restructuring, and doesn’t fall in the category of a specified investment business for that period. This will allow the application of the small business deduction to the active income earned in that period.

Disadvantage of a Corporation Owning a Property

The main disadvantage is the federal tax and the provincial capital tax. The debt as well as the capital invested to acquire the property becomes part of the taxable capital, while the property does not entitle its owner to the investment allowance. Consequently, large amounts of tax and capital tax become payable.

Advantage of a Corporation Owning Property

On the plus side, Capital Gains Deduction (CGD) may be available on the sale of the corporation’s shares if it was carrying on an active business. Keep in mind that the shares would not be eligible for the CGD if the corporation was carrying on a specified investment business.

4. Trusts

Trusts are considered to be individuals and therefore file tax returns. The tax rate for inter vivos trusts created to hold rental property is the maximum rate for individuals. They calculate their rental income the same way individuals do. However, when calculating their income, trusts are allowed to deduct income payable to the beneficiaries of the trust. Therefore the beneficiaries need to pay tax on this income. If all the income goes to the beneficiaries then the tax payable on the rental income may be reduced by taking advantage of the tax rates or tax status of the beneficiaries.

Trusts are not subject to the provincial capital tax or the federal tax. If a business corporation is the beneficiary of a trust, it doesn’t need to account for its share of the taxable capital items of the trust, except for the purposes of the Ontario Capital tax.

Disadvantage

The main disadvantage is the rule on deemed disposition of a trust’s assets every 21 years. If they incur rental losses, they can also subject to the AMT.

Personal and Corporate Tax Rates for Rental Income

Personal Tax Rates

If the rental property is in your name then the rental income will be taxed according to your marginal tax rate. This ranges from 15% to a little over 53% in Ontario.

Corporate Tax Rates

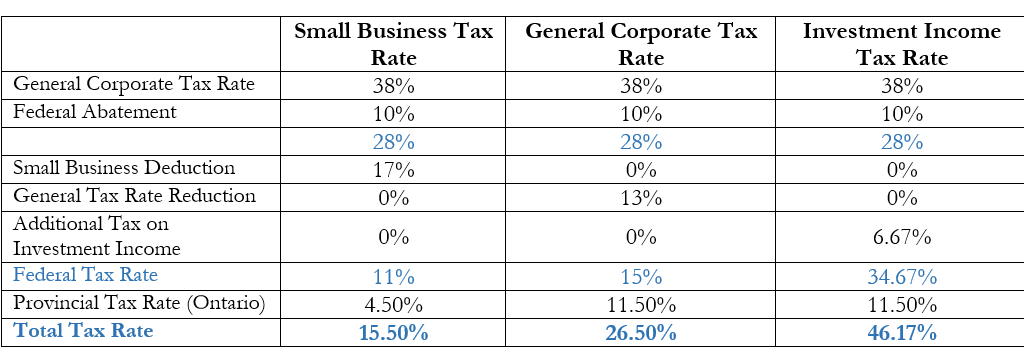

The general corporate rate consists of 38% of the Federal tax and 11.50% of the provincial tax (Ontario) giving us a combined tax rate of 49.50%. Not all corporations pay these rates as tax breaks are available in the form of a 10% federal abatement, a 17% small business deduction and a general rate deduction of 13%.

As shown in the chart below, rental income generated by a corporation falls into three categories.

- If the rental income is active business income and qualifies for the small business deduction then the income is taxed at 15.50%

- If the income is active business income but does not qualify for the small business deduction then it will be taxed at 26.50%

- If the income is not active business income then it will be taxed at 46.17%. This rate can be reduced to 22% when dividends are paid to shareholders. This is done to avoid double taxation.

The team at Syed A. Raza Professional Corporation can help you review your business structure to optimize tax savings. Contact today to get a free consultation.