Here are the basic rules which govern investments in a Registered Retirement Savings Plan.

1. Deduction Limits

Your deduction limit will be available on your Notice of Assessment provided by the Canada Revenue Agency (CRA) after you’ve filed your annual tax return.

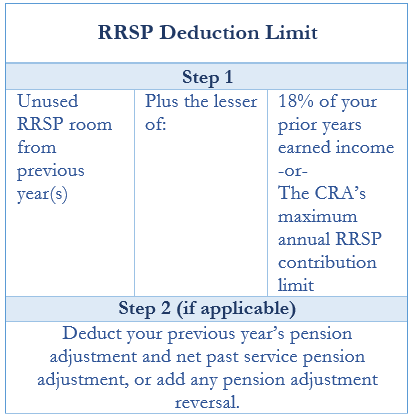

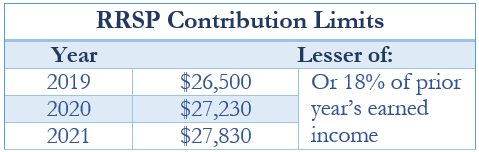

Use the following table to calculate this amount yourself.

2. Earned Income

Sources of earned income include net employment and business income, disability payments, net rental income, royalties, alimony and separation allowances received, allocations from employee profit sharing plans, net research grants and payments from unemployment benefit plans.

3. Previous Year’s Earned Income

Since your RRSP deduction limit is calculated using the previous years earned income, your 2020 contribution will be based on your 2019 earned income.

4. Pension Adjustment

If you’re a member of a Deferred Profit Sharing Plan or a Registered pension Plan, your employer will provide the value of the benefit accrued to you on your annual T4 or T4A. This is called the Pension Adjustment and it reduces your RRSP deduction limit.

5. Pension Adjustment Reversal

The Pension Adjustment Reversal (PAR) is designed to restore lost RRSP contribution room in case you changed jobs before retirement and your termination benefit was lower than your accumulated pension adjustments.

6. Carrying Forward Unused Contribution Room

Can’t take full advantage of the RRSP contribution room you have? No problem. Just defer it till a future year.

7. Carrying Forward Tax Deductibility

This provision allows you to make your RRSP contribution but you don’t have to claim the tax deduction until some other year when it would benefit you more in terms of a tax perspective.

8. Exceeding your Contribution Limit by $2000

Did you know you could exceed your RRSP contribution limit by $2000 without any penalties? However, this does not apply to anyone who is under the age of 18 at any time during the year.

9. RRSP Contribution Deadline

You have 60 days from the end of 2019 to make your RRSP contribution. The last date for making your contribution is March 2, 2020.

10. Starting and Maturing your RRSP

Even a minor child who has earned income can start and contribute to an RRSP. However, you need to file an income tax return even if there’s no tax liability.

The RRSP can continue till the end of the year in which you turn 71. Then you will have to collapse your RRSP. You can either take proceeds in cash or transfer them to one or more of the RRSP maturity options available.

11. Taxes on an RRSP

RRSP contributions grow on a tax deferred basis until they are withdrawn. When a withdrawal is made, it is shown as taxable income on your tax return and you will pay income tax at your marginal tax rate.

12. Investment Options

Qualified investment options for RRSP include the following.

- Canada Savings Bonds

- Guaranteed Investment Certificates

- Mutual Funds

- Exchange-Traded Funds

- Common and preferred shares and bonds issued by corporations, provincial and federal governments.

13. Keeping Good Records

Keeping good records ultimately helps you in taking advantage of the various carry forward provisions or in making excessive contributions. They also help your accountant in uncovering some potentially unclaimed tax deduction.

Contact for more information.